Get The “Daily Prep” FREE!

The Option Coach’s Daily Market Outlook and Trading Plan.

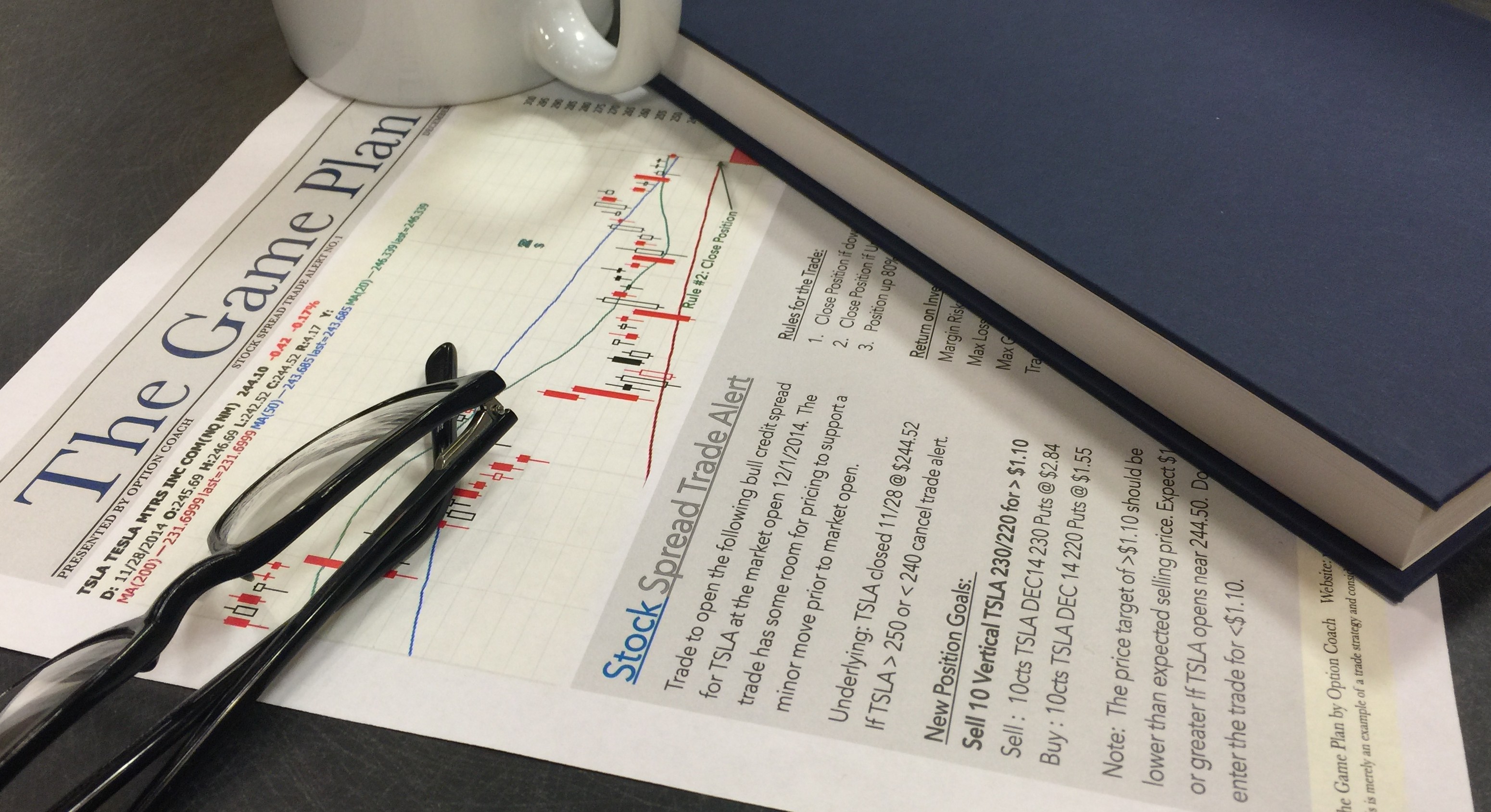

The Game Plan:

The Game Plan:

Extremely low promotional rates! Subscribe to the Game Plan Today!

You get the Option Coach’s “Daily Prep”, the end of the day “Breakdown”, The Game Plan Trade of the Week, access to The Game Plan Blog, Trading Text Updates, and a minimum of three trades executed by the Option Coach per week.

The Volatility Player:

Become a Most Valuable Player of the Option Coach Team with your subscription to the Premium Service of The Volatility Player.

This is the Option Coach’s Premium Service. You get exclusive access to the Option Coach’s Volatility Trading Strategy and full access to the Option Coach’s Services to include the Game Plan.

Learn and Execute Strategic Option Trading

Learn and Execute Strategic Option Trading